Voice AI Transforms Collections: $338K Captured & Scaling Fast

Client Overview

Sector: Financial Services – Debt Collection

Primary Goal: Automate high-volume inbound call handling to improve payment collections

Engagement Type: Inbound-only AI voice support

Call Volume: 50,000+ inbound calls per month

Campaign Duration: 5 months (January – May 2025)

The Challenge

A mid-sized debt collection agency faced rising inbound call volumes and escalating operational costs tied to live agents. Manual call handling was creating significant delays in payment collections and failing to capitalise on after-hours collection opportunities.

Key Pain Points:

- High operational costs from staffing requirements during peak hours

- Missed revenue opportunities outside standard business hours

- Inconsistent call handling leading to delayed payment processing

- Poor customer experience with lengthy wait times

- Limited scalability of traditional manual processes

The AutoCall Solution

AutoCall's AI Voice Agent completely replaced human agents for inbound call handling, delivering a comprehensive automated collections platform.

Core Capabilities:

- 24/7 automated call answering with no staffing limitations

- Secure user verification and seamless payment capture

- Live CRM integration with real-time updates triggered by key events:

- Payment completed or failed attempts

- User identity verification completed

- Callback requests and escalation triggers

- Comprehensive interaction logging

Advanced Handoff Technology:

When calls required human intervention, AutoCall delivered:

- Context-rich warm transfers with complete interaction history

- Pre-briefed agents receiving intent, outcome, and payment status

- Comprehensive call summaries automatically logged in CRM

- Elimination of repetitive explanations improving customer experience

Technical Integration:

- Real-time transcription and analytics across all interactions

- Seamless CRM synchronisation ensuring data accuracy

- Intelligent escalation protocols for complex cases

- Performance monitoring with detailed analytics dashboard

Exceptional Results Achieved

Financial Performance:

- $338,357+ collected in 5 months from AI-handled inbound calls

- Delivering over 27X return on investment

- Consistent monthly growth with peak collection of $161,976.96 in April 2025

- Scalable revenue model proven across diverse collection scenarios

Operational Excellence:

- Call abandonment rate reduced to 0.89% significantly outperforming industry averages

- 100% call coverage with no missed collection opportunities

- CRM accuracy maintained with every action and conversation synchronised in real-time

- Reduced resolution times through AI-briefed agent handoffs

Growth Trajectory:

The success metrics demonstrate remarkable scalability, with the agency now planning:

- 2 million outbound calls monthly over the next 12 months

- Expanded AI deployment across additional collection portfolios

- Enhanced automation capabilities for complex account management

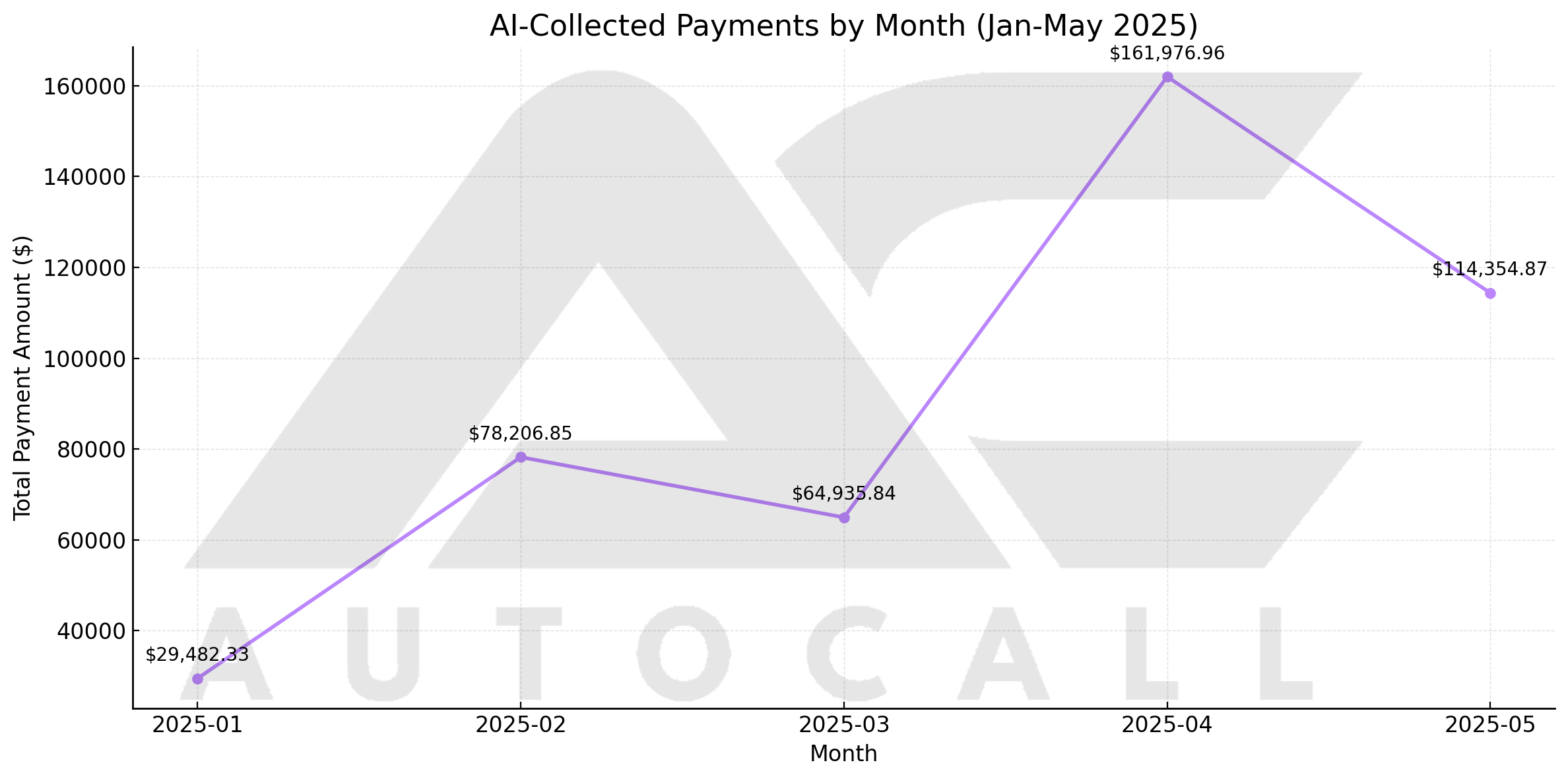

Monthly Collection Performance

The performance data demonstrates exceptional growth throughout the 5-month deployment period, with total collections reaching $338,357+:

Note: The decline in May collections reflects a strategic reduction in outbound call volume as the agency prepared for system scaling and expansion planning.

Month-by-Month Breakdown:

- January 2025: $29,482.33 (baseline establishment)

- February 2025: $78,206.85 (165% month-over-month growth)

- March 2025: $64,935.84 (sustained performance)

- April 2025: $161,976.96 (peak performance, 149% growth)

- May 2025: $114,354.87 (continued strong results)

The chart clearly illustrates the accelerating collection performance, with April 2025 representing the highest single-month collection total of $161,976.96. This trajectory validates AutoCall's scalability and effectiveness in debt collection operations.

Client Testimonial

AutoCall's AI not only answered every call, it briefed our team before handoffs, logged everything into our CRM, and saved us from hiring many agents. It's become core to our collections strategy.

Chief Operations Officer, Debt Recovery Firm

Strategic Value Proposition

Why AutoCall Was Selected:

Comprehensive Automation:

- End-to-end inbound call automation with no human intervention required

- Warm handoff capabilities with complete agent preparation

- Real-time CRM updates for payments, verifications, and escalations

- Full call coverage operating 24/7 without staffing constraints

Proven ROI Model:

- Rapid return on investment with 27X performance ratio

- Scalable methodology ready for significant expansion

- Consistent monthly growth demonstrating sustainable results

- Budget-efficient operation with transparent pricing model

Technical Excellence:

- Seamless integration with existing collection systems

- Advanced natural language processing for authentic interactions

- Comprehensive analytics and performance monitoring

- Intelligent escalation protocols for complex scenarios

Future Scaling Strategy

Building on this exceptional success, the debt collection agency is implementing an aggressive expansion plan:

Next 12 Months:

- 2 million outbound calls monthly leveraging proven AI technology

- Multi-portfolio deployment across diverse debt categories

- Enhanced automation features for complex account management

- Advanced analytics integration for predictive collection strategies

Long-term Vision:

- Industry-leading collection rates through AI optimisation

- Operational cost reduction of 60%+ compared to traditional methods

- 24/7 collection capability maximising revenue opportunities

- Scalable technology platform supporting business growth

Industry Impact

This deployment has established new benchmarks for AI-powered debt collection:

- Highest collection efficiency achieved through intelligent automation

- Industry-leading abandonment rates at 0.89%

- Proven scalability model for rapid business expansion

- Technology leadership in financial services automation

The success demonstrates that AI voice technology can transform traditional collection operations whilst maintaining compliance standards and improving customer experience.

Conclusion

This debt collection transformation showcases the exceptional potential of AI voice technology in financial services. By achieving $338,357+ in collections with a 27X ROI whilst maintaining operational excellence, AutoCall has proven its capability to revolutionise traditional collection processes.

The agency's commitment to scaling toward 2 million monthly outbound calls validates the effectiveness of this approach and positions AutoCall as the preferred technology partner for collection agencies seeking competitive advantages through intelligent automation.

Ready to transform your debt collection operations? Contact AutoCall today to discover how AI voice technology can maximise your collection results whilst optimising operational efficiency.